THANK YOU FOR SUBSCRIBING

Digital Ecosystems are Extending the Boundaries of Value Creation in Insurance

Yannick Even, Director, Head of Digital & Smart Analytics APAC, Swiss Re and Jonathan Anchen, SVP, Insurance Risk Research, Swiss Re

Yannick Even, Director, Head of Digital & Smart Analytics APAC, Swiss Re

Jonathan Anchen, SVP, Insurance Risk Research, Swiss Re

Jonathan Anchen, SVP, Insurance Risk Research, Swiss ReA large portion of the unbanked and uninsured population in Asia is already on mobile devices. The vast majority of the next billion middle class consumers will emerge from Asia; this population is a key segment for future insurance growth. Companies that can quickly transform mobile/digital ecosystem data into risk insights and tailor products and services could be winners. As a flavour of what to expect, it is interesting to see how financial services firms have leveraged scores built by tech giants in China, to onboard new customers and enhance traditional models.

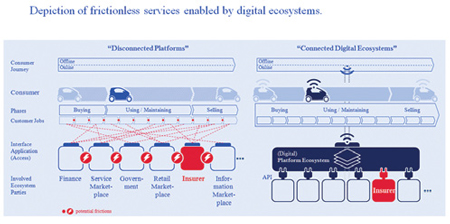

Insurers with more complete knowledge of end customers can play a more active role within an ecosystem

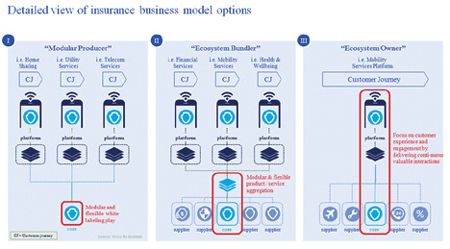

Insurers can adapt to these developments by developing three different set-ups. (1) Modular producer: providing plug-and-play products or services that can adapt to a variety of platforms or ecosystems. (2) Ecosystem bundler: Creating relationships with other providers that offer complementary or sometimes competing services, and (3) Ecosystem owner: More aggressive insurers could act as active ecosystem owners or orchestrators.

Insurers who possess only partial knowledge of the end consumer and typically sell a standard set of offerings through another company, may have to transform into "modular producers". This means being able to offer plug-and-play white label solutions, constantly innovate their products, and rapidly adapt to newer ecosystems as they emerge.

Insurers with more complete knowledge of end customers can play a more active role within an ecosystem. Such insurers typically “own” the customer relationship and currently operate as omni-channel businesses with an integrated value chain which allows them to offer a multi-product, multi-channel customer experience. These insurers could design their business to play the role of an "Ecosystem Bundler" with modular and flexible product/ service aggregation. Here they create relationships with other providers that offer complementary (sometimes competing) services. A bundler can plug an aggregate set of all products and services around insurance into an ecosystem.

Insurers can adapt to these developments by developing three different set-ups. (1) Modular producer: providing plug-and-play products or services that can adapt to a variety of platforms or ecosystems. (2) Ecosystem bundler: Creating relationships with other providers that offer complementary or sometimes competing services, and (3) Ecosystem owner: More aggressive insurers could act as active ecosystem owners or orchestrators.

Insurers who possess only partial knowledge of the end consumer and typically sell a standard set of offerings through another company, may have to transform into "modular producers". This means being able to offer plug-and-play white label solutions, constantly innovate their products, and rapidly adapt to newer ecosystems as they emerge.

Insurers with more complete knowledge of end customers can play a more active role within an ecosystem. Such insurers typically “own” the customer relationship and currently operate as omni-channel businesses with an integrated value chain which allows them to offer a multi-product, multi-channel customer experience. These insurers could design their business to play the role of an "Ecosystem Bundler" with modular and flexible product/ service aggregation. Here they create relationships with other providers that offer complementary (sometimes competing) services. A bundler can plug an aggregate set of all products and services around insurance into an ecosystem.

More aggressive insurers could aspire to be "Ecosystem Owners". In other words, be the sponsor that provides a branded platform and leverages its customer knowledge and data to match customer needs with third-party providers. Their focus is on customer experience and engagement by delivering continuous and valuable interactions. They act as active ecosystem orchestrators, monetizing new technologies and services, and accessing new revenue pools, through proactive interaction based on continuous flow of data (personal, behavioral, etc.)

Irrespective of the choice of business design, this environment requires distinctive capabilities and relies heavily on access to data and the capability to model risks. True leverage will only be created in combination with other assets, such as key partnerships with suppliers and other firms that allow re/insurers access to ecosystems. Utilised more fully and intelligently, digital ecosystems present an opportunity for the insurance industry to reinforce its relevance to its clients whose tastes and protection needs are changing.

More aggressive insurers could aspire to be "Ecosystem Owners". In other words, be the sponsor that provides a branded platform and leverages its customer knowledge and data to match customer needs with third-party providers. Their focus is on customer experience and engagement by delivering continuous and valuable interactions. They act as active ecosystem orchestrators, monetizing new technologies and services, and accessing new revenue pools, through proactive interaction based on continuous flow of data (personal, behavioral, etc.)

Irrespective of the choice of business design, this environment requires distinctive capabilities and relies heavily on access to data and the capability to model risks. True leverage will only be created in combination with other assets, such as key partnerships with suppliers and other firms that allow re/insurers access to ecosystems. Utilised more fully and intelligently, digital ecosystems present an opportunity for the insurance industry to reinforce its relevance to its clients whose tastes and protection needs are changing.

Weekly Brief

I agree We use cookies on this website to enhance your user experience. By clicking any link on this page you are giving your consent for us to set cookies. More info

Read Also