THANK YOU FOR SUBSCRIBING

Establishing Trust from Business Stakeholders

Ash Shah, Regional P&C CIO and Chief of Staff, AXA, Asia Region

Ash Shah, Regional P&C CIO and Chief of Staff, AXA, Asia Region

Over the past five years, technology in the insurance industry has changed rapidly. With the advent of mobile and digital capabilities, greater focus on customer-centricity, process improvements through automation and cloud solutions, the mindset of managing the business through a basic, static insurance administration system is no longer feasible.

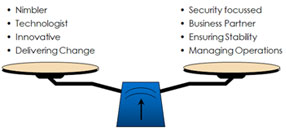

Market forces have now driven CIOs to increasingly focus on system stability than undertaking sheer technological practices. CIOs are now expected to become more strategically aligned with business objectives and focused on solving business problems in meeting the evolving needs and expectations from end users.

Personally, as a CIO, it is difficult to understand where to start and how to manage these competing expectations. In my experience, the most critical aspect to achieve this balance is to ensure that the CIO and the business are intrinsically aligned. To achieve this, here are a number of strategies I have utilized to build this alignment.

1. Form a high performing IT business partnership team

Depending on the size of your organization, a CIO cannot be everywhere and engage with every key stakeholder across the business. To help build relationships with the business and align both the business and technology agenda, delegation is required.

The approach I have found most effective is to form a high performing IT business partnership team to be a single point of accountability for a designated business relationship in all aspects of IT, spanning from strategy development, through to IT operations.

This team should be a key cog to grease the wheels in the local IT department. Its members should be trusted advisers to their assigned business unit, and the first point of contact to provide solutions to business problems and challenges.

Critical to this team is its composition and the skill sets brought along by its members. To be successful, this IT business partnership team needs to be a melting pot of different cultures, skills, knowledge, and experience. The team members need to be senior leaders in the IT community, with the capabilities and readiness to stand in as the next CIO.

For instance, in my team, we have had a breadth of skills ranging from business unit management and business consulting to program delivery, with each individual having over 15 years of IT experience.

In the insurance industry, the amount of disruptive technology entering the market is currently exploding